New QMS Regulations:

What BAS Agents & Bookkeepers Need to Know

The new Quality Management Standards (QMS) regulations in Australia are set to shake up the way BAS agents and bookkeepers handle their compliance and risk management. If you provide BAS agent services, these changes will directly impact how you manage your practice and ensure compliance. My CPE is here to help you decipher and navigate these changes through providing you with information, education and products to support your business.

So, what’s changing?

The new QMS regulations mandate a proactive, risk-based approach to quality management. Unlike previous compliance checklists, businesses must now identify, assess, and mitigate risks specific to their services. If your business provides non-assurance services, revised APES 320 also requires a tailored System of Quality Management (QMS) to ensure professional integrity. It’s a new requirement that expands the existing code under Code Item 17.

It’s mandatory, not optional.

This requirement applies to large firms with more than 100 employees from the 1st of January, while smaller firms – including many BAS agent firms – must comply by the 1st of July 2025. Implementing the QMS requirement is part of a broader set of professional ethical obligations, ensuring compliance with the Tax Agent Services Act, proper disclosures to clients, managing false and misleading statements, and ultimately, ensuring competent provision of services.

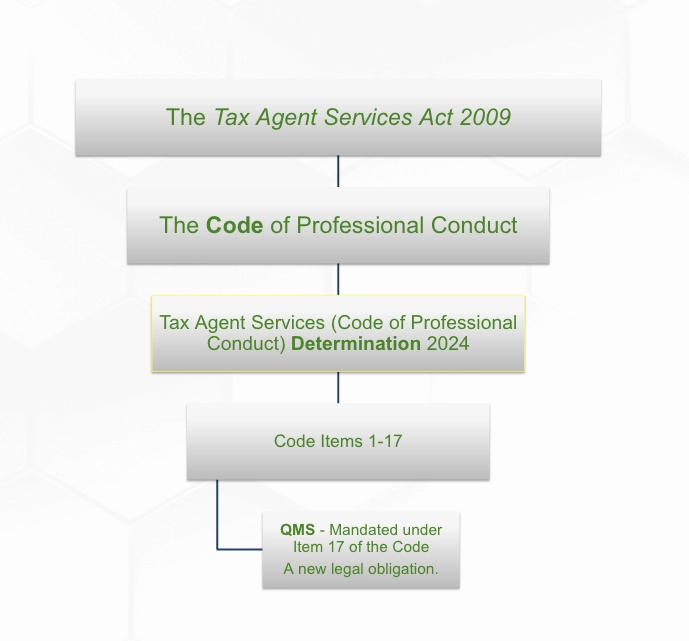

The Regulatory Framework

If you’re unfamiliar with the regulatory framework, it all stems from the Tax Agent Services Act 2009, flowing through the Code of Professional Conduct, and ultimately being enforced via Section 40 of the Tax Agent Services Code of Professional Conduct Determination. This section mandates the obligation to establish and maintain a quality management system for BAS agents and bookkeepers. Your QMS should be designed to provide confidence that you are meeting your professional conduct obligations and ensuring the accuracy of financial records. Additional details are available here https://www.tpb.gov.au/code-determination-background-and-context

(MY CPE HIGHLIGHTING THE FRAMEWORK FOR QMS MANAGEMENT)

The Documentation Requirement The QMS must be a documented system of policies and procedures that will be enforced. This aligns with TPB requirements and the standards issued by the Australian Professional and Ethical Standards Board (APESB), ensuring appropriate quality management processes.

What Can Businesses Do Now to Prepare for the QMS?

- Assess your current quality management system to identify gaps and opportunities for growth and business development through this time.

- Train your team on the new compliance expectations. Enrolling in My CPE offerings here can help build the confidence and understanding of these new mandates for your entire team.

- Invest and research in digital solutions that streamline risk assessment and monitoring. Really consider the adaptability of your solutions to what your business needs. Big and small BAS agents and bookkeepers will require different levels of risk mitigation and reporting.

Seek expert advice to ensure full compliance with the new regulations. My CPE are here to support you and your goals within this evolving industry. Ensure you are receiving the educational support you need to make the most out of these changes.

Summary of Impact on BAS Agents

- Increased Compliance Costs – Setting up a structured quality management system requires resources, training, and potential software investments.

- Greater Accountability – You must document and monitor risk assessment processes to ensure ongoing compliance with evolving standards.

- Competitive Advantage – BAS agents and bookkeepers who adopt these changes early can demonstrate professionalism and attract more clients looking for compliant and high-quality services.

- Operational Overhaul – From client documentation to internal risk management, every bookkeeping and BAS service provider must rethink their processes to ensure they align with the new regulations.

While these new QMS regulations may feel like a challenge, My CPE can also see the upcoming opportunity to streamline processes, both maintain and increase service quality and build client trust. Adapting early will not only keep you compliant but also give your business a competitive edge in this rapidly evolving market.

Need help navigating the changes? My CPE is here to help with our products and industry updates for QMS. You can learn more about the upcoming changes by listening to Sonya, CEO of My CPE on our recent webinar, available here.

Decoding the Code: QMS, Disclosures and Mandatory Reporting

This course is ideal for registered practitioners who wish to understand the new Code obligations, including the new QMS, Disclosure, and Mandatory Breach Reporting requirements.

Read our other blogs here

New QMS Regulations: What BAS Agents & Bookkeepers Need to Know The new Quality Management

An update on Super changes moving towards fairer and more consistent super practices across Australia.

Change is in the wind! In the ever-evolving landscape of the BAS and tax profession,

News from the TPB has just been released about the significant changes to the Code

In 2024, the Australian Cyber Security Centre (ACSC) reported a 14% rise in the average cost of cybercrime reports across various business sizes.

Update on the significant impacts to compliance and operational procedures for tax and BAS agents.

No changes or insights clarifying new Code requirements from TPB last week.

Our response to the PwC fiasco on the new compliance rules and how we can help you.

New TASA obligations to take effect from the 1st of August 2024.

10 vital tips for managing your cash flow effectively.

As a business owner or manager it is crucial to understand the Australian consumer laws (ACL) governing trading operations. Adhering to these laws and mandated industry codes of practice ensures that businesses operate fairly and competitively and that consumers are properly informed and protected.

Let's face it, keeping your financial ducks in a row isn't always a walk in the park, but it's essential for the health of your business. Many of us fall into common traps that can lead to some serious headaches down the track. So, let's explore these pitfalls and how to steer clear of them.

The Fair Work Commission (FWC) in Australia has introduced several changes affecting various aspects of employment regulations.

What does a Payroll Officer do?

Payroll officers undertake various tasks which include crunching numbers and collecting information about employees. They

Government Skills Checkpoint Program / Skills and Training Incentive

Government Skills and Training Incentive – up to $2,200 (inc GST) Act NOW while funding

Queensland Business Basics Grants – My CPE Packages

Hi Queenslanders, Interested in getting $5,000 worth of CPE training plus marketing support from us

CPE for NDIS Plan Managers

One of the requirements for NDIS Plan Managers is to maintain membership of a registered

Government Funding – The Mid-Career Checkpoint program

Up to $3,000 is available to support enrolment in accredited training for eligible participants. The